Home Owners' Loan Corporation

This article includes a list of general references, but it lacks sufficient corresponding inline citations. (February 2015) |

The former federal headquarters of the Home Owners' Loan Corporation[1] | |

| Company type | Government-sponsored corporation |

|---|---|

| Industry | Financial services |

| Founded | June 13, 1933 |

| Defunct | February 4, 1954 |

| Headquarters | Washington, D.C. |

| Services | Credit services |

Number of employees | 20,000 (1935) and declined to less than 500 (1950) |

The Home Owners' Loan Corporation (HOLC) was a government-sponsored corporation created as part of the New Deal. The corporation was established in 1933 by the Home Owners' Loan Corporation Act under the leadership of President Franklin D. Roosevelt.[2] Its purpose was to refinance home mortgages currently in default to prevent foreclosure, as well as to expand home buying opportunities.

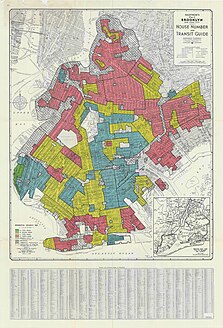

The HOLC created a housing appraisal system of color-coded maps that categorized the riskiness of lending to households in different neighborhoods. While the maps relied on various housing and economic measures, they also used demographic information (such as the racial, ethnic, and immigrant composition of neighborhoods) to categorize creditworthiness.[3] Since Kenneth T. Jackson's work in the 1980s, a number of studies have found that HOLC was a key promoter of redlining and a driver of racial residential segregation and racial wealth inequality in the United States.[4][5][3]

Organizational history

[edit]HOLC was established as an emergency agency under Federal Home Loan Bank Board (FHLBB) supervision by the Home Owners' Loan Act of 1933, June 13, 1933.[6] It was transferred with FHLBB and its components to the Federal Loan Agency by Reorganization Plan No. I of 1939, effective July 1, 1939. It was assigned with other components of abolished FHLBB to the Federal Home Loan Bank Administration (FHLBA), National Housing Agency, by EO 9070, February 24, 1942. Its board of directors was abolished by Reorganization Plan No. 3 of 1947, effective July 27, 1947, and HOLC was assigned, for purposes of liquidation, to the Home Loan Bank Board within the Housing and Home Finance Agency. It was terminated by order of Home Loan Bank Board Secretary, effective February 3, 1954, pursuant to an act of June 30, 1953 (67 Stat. 121).

Operations

[edit]The HOLC issued bonds and then used the bonds to purchase mortgage loans from lenders. The loans purchased were for homeowners who were having problems making the payments on their mortgage loans "through no fault of their own". The HOLC refinanced the loans for the borrowers. Many of the lenders gained from selling the loans because the HOLC bought the loans by offering a value of bonds equal to the amount of principal owed by the borrower, plus unpaid interest on the loan, plus taxes that the lender paid on the property. This value of the loan was the amount of the loan that was refinanced for the borrower. The borrower gained because they were offered a loan with a longer time frame at a lower interest rate. It was rare to reduce the amount of principal owed.

Loan repayments and foreclosure policies

[edit]Between 1933 and 1935, the HOLC made slightly more than one million loans. At that point it stopped making new loans and then focused on the repayments of the loans. The typical borrower whose loan was refinanced by the HOLC was more than 2 years behind on payments of the loan and more than 2 years behind on making tax payments on the property. The HOLC eventually foreclosed on 20 percent of the loans that it refinanced. It tended to wait until the borrower had failed to make payments on the loan for more than a year before it foreclosed on the loan. When the HOLC foreclosed, it typically refurbished the home. In many cases it rented out the home until it could be resold. The HOLC tried to avoid selling too many homes quickly to avoid having negative effects on housing prices. Ultimately, more than 800,000 people repaid their HOLC loans, and many repaid them on time.[7][8] HOLC officially ceased operations in 1951, when its last assets were sold to private lenders. HOLC was only applicable to nonfarm homes, worth less than $20,000. HOLC also assisted mortgage lenders by refinancing problematic loans and increasing the institutions' liquidity. When its last assets were sold in 1951, HOLC turned a small profit.[9][10]

Redlining

[edit]

HOLC is often cited as the originator of mortgage redlining.[11][12]HOLC maps[13] generated during the 1930s to assess credit-worthiness were color-coded by mortgage security risk, with majority African-American areas disproportionately likely to be marked in red indicating designation as "hazardous."[14] These maps were made as part of HOLC's City Survey project that ran from late 1935 until 1940.[15] Perhaps ironically, HOLC had issued refinancing loans to African American homeowners in its initial "rescue" phase before it started making its redlining maps.[16] The racist attitudes and language found in HOLC appraisal sheets and Residential Security Maps created by the HOLC gave federal support to real-estate practices that helped segregate American housing throughout the 20th century.[17]

The effects of redlining, as noted in HOLC maps, endures to the present time. A study released in 2018 found that 74 percent of neighborhoods that HOLC graded as high-risk or "hazardous" are low-to-moderate income neighborhoods today, while 64 percent of the neighborhoods graded "hazardous" are minority neighborhoods today.[18] "It's as if some of these places have been trapped in the past, locking neighborhoods into concentrated poverty," said Jason Richardson, director of research at the NCRC, a consumer advocacy group.[19]

A 2020 study in the American Sociological Review found that HOLC led to substantial and persistent increases in racial residential segregation.[4] A 2021 study in the American Economic Journal found that areas classified as high-risk on HOLC maps became increasingly segregated by race during the next 30–35 years, and suffered long-run declines in home ownership, house values, and credit scores.[20] HOLC's evaluation of neighborhoods in the 1930s correlates with "health, employment, education, and income measures" in these same neighborhoods decades later.[21]

Since the rediscovery of HOLC documents in the 1980s, there has been considerable debate about the exact role of HOLC and its maps in redlining: even as the neighborhood evaluations largely align with race and with ongoing disparities, it is unclear exactly how much of an effect HOLC itself had.[22] According to a paper by economic historian Price V. Fishback and three co-authors, issued in 2021,[23] the blame placed on HOLC is misplaced. Far from "ironically" issuing a few loans to African-Americans in an "initial phase" and then becoming a major promoter of redlining, HOLC actually refinanced mortgage loans for African-Americans in near proportion to the share of African-American homeowners.[neutrality is disputed] The pattern of loans had basically no relationship to the "redlining" maps because the program to create the maps did not even begin until after 90% of HOLC refinancing agreements had already been concluded.[neutrality is disputed]

However, the HOLC shared their maps with the other major New Deal housing program, the Federal Housing Administration. But, the FHA already had its own discriminatory program of systematically rating urban neighborhoods and the HOLC used the FHA's discriminatory guidelines for its maps.[24]

As for private lenders, though Kenneth T. Jackson's claim that they relied on the HOLC's maps to implement their own discriminatory practices has been widely repeated, the evidence is weak that private lenders had access to the maps.[23]: 10-11 By contrast, it is well documented that private lenders understood which neighborhoods the FHA favored and disfavored; suburban greenfield developers often explicitly advertised the FHA-insurability of their properties in ads for prospective buyers. Redlining was an established practice in the real estate industry before the federal government had any significant role in it; to the extent that any federal agency is to blame for perpetuating the practice, it is the Federal Housing Administration and not the Home Owners' Loan Corporation.[25][23]

See also

[edit]Footnotes

[edit]- ^ "Renovation of the Home Owners Loan Corporation (HOLC) Building". John C. Grimberg Company. Archived from the original on January 24, 2013. Retrieved December 23, 2010.

- ^ First Annual Report of the Federal Home Loan Bank Board

- ^ a b Aaronson, Daniel; Hartley, Daniel; Mazumder, Bhashkar; Stinson, Martha (2022). "The Long-Run Effects of the 1930s Redlining Maps on Children". Journal of Economic Literature. doi:10.1257/jel. ISSN 0022-0515.

- ^ a b Faber, Jacob W. (2020-08-21). "We Built This: Consequences of New Deal Era Intervention in America's Racial Geography". American Sociological Review. 85 (5): 739–775. doi:10.1177/0003122420948464. ISSN 0003-1224.

- ^ Aaronson, Daniel; Hartley, Daniel; Mazumder, Bhashkar (2021). "The Effects of the 1930s HOLC "Redlining" Maps". American Economic Journal: Economic Policy. 13 (4): 355–392. doi:10.1257/pol.20190414. hdl:10419/200568. ISSN 1945-7731. S2CID 204505153.

- ^ "Records of the Federal Home Loan Bank Board [FHLBB]". National Archives. 2016-08-15. Retrieved 2017-10-24.

- ^ Harriss, C. Lowell (1951). "History and Policies of the Home Owners' Loan Corporation". NBER (1st ed.). New York: National Bureau of Economic Research: 1.

- ^ Fishback, Price; Rose, Jonathan; Snowden, Kenneth (October 2013). Well Worth Saving: How the New Deal Safeguarded Home Ownership (1st ed.). Chicago: University of Chicago Press. ISBN 978-0226082448.

- ^ Crossney and Bartelt 2005 Urban Geography article Archived 2012-07-09 at archive.today

- ^ "Crossney and Bartelt 2006 Housing Policy Debate" (PDF). Archived from the original (PDF) on 2008-04-14. Retrieved 2008-04-12.

- ^ "In U.S. Cities, The Health Effects Of Past Housing Discrimination Are Plain To See". NPR.org. Retrieved 2020-12-13.

- ^ "Racist housing policies have created some oppressively hot neighborhoods". Science. 2020-09-02. Archived from the original on September 3, 2020. Retrieved 2020-12-13.

- ^ Connolly, N. D. B.; Winling, LaDale; Nelson, Robert K.; Marciano, Richard (2018-01-19), "Mapping inequality", The Routledge Companion to Spatial History, Routledge, pp. 502–524, doi:10.4324/9781315099781-29, ISBN 9781315099781

- ^ Nelson, Robert K. "Mapping Inequality". Mapping Inequality. University of Richmond.

- ^ Michney, Todd M (November 2022). "How the City Survey's Redlining Maps Were Made: A Closer Look at HOLC's Mortgagee Rehabilitation Division". Journal of Planning History. 21 (4): 316–344. doi:10.1177/15385132211013361. S2CID 236560695.

- ^ Michney, Todd M; Winling, LaDale (January 2020). "New Perspectives on New Deal Housing Policy: Explicating and Mapping HOLC Loans to African Americans". Journal of Urban History. 46 (1): 150–180. doi:10.1177/0096144218819429. ISSN 0096-1442. S2CID 149628183.

- ^ Freund, David M.P. (2007). Colored Property: State Policy and White Racial Politics in Suburban America. Chicago: University of Chicago Press. ISBN 978-0-226-26276-5.

- ^ Mitchell, Bruce (2018-03-20). "HOLC "redlining" maps: The persistent structure of segregation and economic inequality". National Community Reinvestment Coalition.

- ^ Jan, Tracy. "Redlining was banned 50 years ago. It's still hurting minorities today". Washington Post.

- ^ Aaronson, Daniel; Hartley, Daniel; Mazumder, Bhashkar (2021). "The Effects of the 1930s HOLC "Redlining" Maps". American Economic Journal: Economic Policy. 13 (4): 355–392. doi:10.1257/pol.20190414. hdl:10419/200568. ISSN 1945-7731. S2CID 204505153.

- ^ White, Anna G.; Guikema, Seth D.; Logan, Tom M. (July 2021). "Urban population characteristics and their correlation with historic discriminatory housing practices". Applied Geography. 132: 102445. doi:10.1016/j.apgeog.2021.102445. S2CID 236261789.

- ^ Markley, Scott (July 7, 2023). "Federal 'redlining' maps: A critical reappraisal". Urban Studies. 61 (2): 195–213. doi:10.1177/00420980231182336.

- ^ a b c Fishback, Price; Rose, Jonathan; Snowden, Kenneth; Storrs, Thomas (2021). "New Evidence on Redlining by Federal Housing Programs in the 1930s". Journal of Urban Economics. doi:10.3386/w29244. hdl:10419/251011. S2CID 239123963.

- ^ "Part II, Section 9, Rating of Location". Underwriting Manual: Underwriting and Valuation Procedure Under Title II of the National Housing Act With Revisions to February 1938. Washington, D.C.: Federal Housing Administration. Archived from the original on 2012-12-20. Retrieved 2023-06-07.

Recommended restrictions should include provision for the following: Prohibition of the occupancy of properties except by the race for which they are intended [...] Schools should be appropriate to the needs of the new community and they should not be attended in large numbers by inharmonious racial groups

- ^ "Redlining Didn't Happen Quite the Way We Thought It Did". 21 September 2021.

Further reading

[edit]- Brennana, John F. "The Impact of Depression-era Homeowners' Loan Corporation Lending in Greater Cleveland, Ohio," Urban Geography, (2015) 36#1 pp: 1-28.

- Price Fishback, Jonathan Rose, and Kenneth Snowden, Well Worth Saving: How the New Deal Safeguarded Home Ownership. Chicago: University of Chicago Press, 2013.

External links

[edit]- Records of the Home Owners' Loan Corporation from the National Archives and Records Administration

- Security maps of the Home Owners' Loan Corporation for several U.S. cities Archived 2015-03-31 at the Wayback Machine

- Mapping Inequality: Redlining in New Deal America

- Annual reports of the Home Owners' Loan Corporation from 1933 through 1952, included in reports of the Federal Home Loan Bank Board