User:Egoli/sandboxpeakcopper

| This is not a Wikipedia article: It is an individual user's work-in-progress page, and may be incomplete and/or unreliable. For guidance on developing this draft, see Wikipedia:So you made a userspace draft. Find sources: Google (books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| It has been suggested that this page be merged into Peak copper. (Discuss) Proposed since June 2008. |

Peak copper

A very scholarly article on the long term availability of metals, with the emphasis on copper by three academics from Yale and Harvard, but oddly enough they do not consider the effect of high demand on price and the effect of high prices on production and the change in reserves and resources[1]

A reasonalbly balanced article which doubts some ot the more bearish comments and comments on the likely effect of higher metal prices[2]

Credit Suisse examine 65 new or planned projects which could add 8 million tonnes to annual production[3]

Mining Journal confirms credit Suisse story [4]

Peak copper is the name given to the theoretical point at which the maximum global copper production rate is reached[5][6], after which the rate will enter terminal decine. Copper is one of the most important industrial metals and is, naturally, a finite resource which will eventually be exhausted if not recycled. However, it is virtually impossible to say when or whether such an event may occur. The future of copper is a complex interplay of substitution, economy of use, technological change, metal price and mining and processing costs.

Substitution[edit]

At the CRU World Copper Conference in Santiago Chile in 2006[7], when copper was only US$2.60/lb, copper producers and analysts were ambivalent about the likelihood of widespread substitution but several were clearly worried that it could happen. The current price (June 2008) is US$3.80/lb and must be accentuating those worries.

In practice, substitution may not be such a serious problem per se but every copper user must now be looking at how to reduce the amount of copper they use in their products. There are areas where substitution has already made inroads - fibre optics - which must be looking progressively more attractive in smaller scale applications. It has often been said that the biggest copper deposit in the world is the telephone cable network under New York.

The current high price cuts both ways. If it is maintained, substitution will be encouraged, especially by aluminium which is also an excellent conductor. On the other hand many previously subeconomic resources have now become economic ore and the potential near term availability of the metal has been boosted considerably.

Supply Factors[edit]

Most studies on copper supply

The current high price cuts both ways. If it is maintained, substitution will be encouraged, especially by aluminium which is also an excellent conductor. On the other hand many previously subeconomic resources have now become economic ore and the potential near term availability of the metal has been boosted considerably.

The current high price cuts both ways. If it is maintained, substitution will be encouraged, especially by aluminium which is an excellent conductor. On the other hand many previously subeconomic resources have now become economic ore and the potential near term availability of the metal has been boosted considerably.

Supply factors[edit]

}}</ref> |- ! Country ! 2002 ! 2003 ! 2004 ! 2005 ! 2006 ! 2007 |- | Chile | 4,580 | 4,860 | 5,410 | 5,320 | 5,560 | 5,700 |- | United States | 1,140 | 1,120 | 1,160 | 1,150 | 1,200 | 1,190 |- | China | 585 | 565 | 620 | 640 | 890 | 920 |- | Peru | 843 | 850 | 1040 | 1090 | 1049 | 1200 |- | Poland | 503 | 500 | 531 | 530 | 512 | 470 |- | Australia | 873 | 870 | 854 | 930 | 859 | 860 |- | Mexico | 330 | 330 | 406 | 420 | 338 | 400 |- | Indonesia | 1,160 | 1,170 | 840 | 1,050 | 816 | 780 |- | Zambia | 330 | 330 | 427 | 450 | 476 | 530 |- | Russia | 695 | 700 | 675 | 675 | 725 | 730 |- | Khazakhstan | 490 | 480 | 461 | 400 | 457 | 460 |- | Canada | 600 | 580 | 546 | 580 | 607 | 585 |- | Other Countries | 1,500 | 1,500 | 1,610 | 1,750 | 1,835 | 1,800 |- | Total | 13,600 | 13,900 | 14,600 | 14,900 | 15,100 | 15,600 |}

Peak copper is the point in time at which the maximum global copper production rate is reached, after which, according to theory, the production rate will enter terminal decline. Copper is among the most important industrial metals. Like fossil fuels, copper is a finite resource. Copper is being used extensively in electrical power cables, data cables, electrical equipment, automobile radiators, cooling and refrigeration tubing, heat exchangers, artillery shell casings, water pipes and even jewellery. This reddish-brown metal is a commodity that the world cannot afford to be in short supply of.

Copper has been in use at least 10,000 years, but more than 95 percent of all copper ever mined and smelted has been extracted since 1900. And as India and China race to catch up with the West, copper is becoming in short supply,[8] leading to increased prices and an increase in copper theft.

North America alone mined 164 million metric tons of the reddish-brown metal.[9]

Copper demand[edit]

Copper demand is increasing by more than 575,000 tons annually and accelerating.[8] Demand for copper shows no sign of levelling off. Based on 2006 figures for per capita consumption, Tom Graedel and colleagues at Yale University calculate that by 2100 global demand for copper will outstrip the amount extractable from the ground.[10] China accounts for more than 22% of world copper demand.[11]

Copper supply[edit]

Globally, economic copper resources are being depleted with the equivalent production of three world-class copper mines being consumed annually.[8] Environmental analyst, Lester Brown has suggested copper might run out within 25 years based on a reasonable extrapolation of 2% growth per year.[12]

New copper discoveries[edit]

Only 56 new copper discoveries have been made during the past three decades.[8] World discoveries of copper peaked in 1996.[13]

Production[edit]

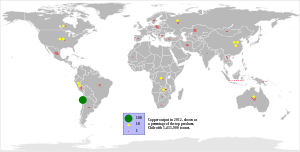

The chief producers of copper are Chile, United States, Indonesia, and Peru.[14] 21 of the 28 largest copper mines in the world are not amenable to expansion.[8] Many large copper mines will be exhausted between 2010 and 2015.[8]

| Country | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 |

|---|---|---|---|---|---|---|

| Chile | 4,580 | 4,860 | 5,410 | 5,320 | 5,560 | 5,700 |

| United States | 1,140 | 1,120 | 1,160 | 1,150 | 1,200 | 1,190 |

| China | 585 | 565 | 620 | 640 | 890 | 920 |

| Peru | 843 | 850 | 1040 | 1090 | 1049 | 1200 |

| Poland | 503 | 500 | 531 | 530 | 512 | 470 |

| Australia | 873 | 870 | 854 | 930 | 859 | 860 |

| Mexico | 330 | 330 | 406 | 420 | 338 | 400 |

| Indonesia | 1,160 | 1,170 | 840 | 1,050 | 816 | 780 |

| Zambia | 330 | 330 | 427 | 450 | 476 | 530 |

| Russia | 695 | 700 | 675 | 675 | 725 | 730 |

| Khazakhstan | 490 | 480 | 461 | 400 | 457 | 460 |

| Canada | 600 | 580 | 546 | 580 | 607 | 585 |

| Other Countries | 1,500 | 1,500 | 1,610 | 1,750 | 1,835 | 1,800 |

| Total | 13,600 | 13,900 | 14,600 | 14,900 | 15,100 | 15,600 |

Reserves[edit]

The U.S. Geological Survey suggests that the total reserve base of copper (economic and uneconomic) is 1.6 billion tonnes, but only the 950 million tonnes of its 2005 summary can be recovered.[9]

| Country | Reserves | Percent | Reserve Base | Percent |

|---|---|---|---|---|

| Chile | 150,000 | 30.61% | 360,000 | 38.30% |

| United States | 35,000 | 7.14% | 70,000 | 7.45% |

| China | 26,000 | 5.31% | 63,000 | 6.70% |

| Peru | 30,000 | 6.12% | 60,000 | 6.38% |

| Poland | 30,000 | 6.12% | 48,000 | 5.11% |

| Australia | 24,000 | 4.90% | 43,000 | 4.57% |

| Mexico | 30,000 | 6.12% | 40,000 | 4.26% |

| Indonesia | 35,000 | 7.14% | 38,000 | 4.04% |

| Zambia | 19,000 | 3.88% | 35,000 | 3.72% |

| Russia | 20,000 | 4.08% | 30,000 | 3.19% |

| Khazakhstan | 14,000 | 2.86% | 20,000 | 2.13% |

| Canada | 9,000 | 1.84% | 20,000 | 2.13% |

| Other Countries | 35,000 | 7.14% | 110,000 | 11.70% |

| Total | 490,000 | 100% | 940,000 | 100% |

Known conventional resources[edit]

Recycling[edit]

Each year in the USA, more copper is recovered and put back into service from recycled material than is derived from newly mined ore. Copper’s recycle value is so great that premium-grade scrap normally has at least 95% of the value of primary metal from newly mined ore.[18]

Undiscovered conventional resources[edit]

Based on current discovery rates and existing geologic surveys, the researchers estimated that 1.6 billion metric tons of copper exist that could potentially be brought into use. This figure relies on the broadest possible definition of available copper as well as a lack of energy constraints and environmental concerns.[9]

Unconventional resources[edit]

Deep-sea nodules are estimated to contain 700 million tonnes of copper.

Peak copper for individual nations[edit]

Chile[edit]

Chile, which produces one third of the world's copper, may begin to decline irreversibly in 2008[8]

Poland[edit]

Poland peaked in 1970 at 2 million tonnes per year.[19]

Zaire[edit]

In Zaire, Copper production fell by 90% from 1976 (502,000 tons) to wartime 1993 (50,000 tons)[20]

Copper price[edit]

Some of the world’s most respected companies and institutions in copper futures are saying that copper prices will fluctuate between 280 and 360 cents per pound in 2008, with an average of approximately 325 cents, similar to that of 2007.[21] The price of copper struck its highest ever on March 6, 2008 on the London Metal Exchange (LME), surging 5.8 percent over the previous trading day to 4.02 dollars per pound. The previous record was set on May 12, 2006 at 3.98 dollars per pound. The international copper price has been increasing rapidly since the beginning of 2008. Copper prices rose 23 percent February of 2008.[22]

See also[edit]

References[edit]

- ^ Metal Stocks and Sustainability, R. B. Gordon*, M. Bertram†‡, and T. E. Graedel

- ^ Peak Copper?, Andrew Leonard

- ^ Significant spike in 2008 copper price

- ^ world mining stocks

- ^ Metal stocks and sustainability

- ^ How the World Works, Andrew Leonard

- ^ Copper industry downplays substitution risk ;;

- ^ a b c d e f g Andrew Leonard (2006-03-02). "Peak copper?". Salon - How the World Works. Retrieved 2008-03-23.

- ^ a b c David Biello (2006-01-17). "Measure of Metal Supply Finds Future Shortage". Scientific American. Retrieved 2008-03-23.

- ^ David Cohen (2007-05-23). "Earth's natural wealth: an audit". New Scientist. p. pp. 34-41. Retrieved 2008-04-09.

{{cite web}}:|page=has extra text (help) - ^ Dan Glaister, Tania Branigan and Owen Bowcott (2008-03-20). "Deaths and disruption as price rise sees copper thefts soar". The Guardian. Retrieved 2008-04-09.

- ^ Brown, Lester (2006). Plan B 2.0: Rescuing a Planet Under Stress and a Civilization in Trouble. New York: W.W. Norton. p. 109. ISBN 0393328317.

- ^ Charleston Voice (2005-12-29). "Peak Copper Means Peak Silver". Retrieved 2008-04-09.

- ^ Samuel K. Moore (2008-03). "Supply Risk, Scarcity, and Cellphones". IEEE Spectrum. Retrieved 2008-03-23.

{{cite web}}: Check date values in:|date=(help) - ^ "pg. 54 - Copper" (PDF). USGS. 2004. Retrieved 2008-04-09.

- ^ "pg. 56 - Copper" (PDF). USGS. 2006. Retrieved 2008-04-09.

- ^ a b "pg. 54 - Copper" (PDF). USGS. 2008. Retrieved 2008-04-09.

- ^ "Copper in the USA: Bright Future – Glorious Past". Copper Development Association. Retrieved 2008-04-09.

- ^ Marcin Piwocki and Stanislaw Przenioslo (2004). "Mineral raw materials and commodities of Poland" (PDF). Przeglad Geologiczny. Retrieved 2008-04-09.

- ^ "Zaire: IRIN Briefing Part II". University Of Pennsylvania. 1997-02-27. Retrieved 2008-04-09.

- ^ Daniela Estrada (2008-01-11). "CHILE: Copper Boom - Cui Bono?". IPS. Retrieved 2008-03-23.

- ^ "International copper price hits record high". China view. 2008-03-08. Retrieved 2008-04-09.

External references[edit]

- Copper.org

- R. B. Gordon*, M. Bertram and T. E. Graedel (2006-01-31). "Metal Stocks and Sustainability". 103 (5). Proceedings of the National Academy of Sciences: pp. 1209–1214. Retrieved 2008-03-23.

{{cite journal}}:|pages=has extra text (help); Cite journal requires|journal=(help)

Category:Economic theories Category:Futures studies Category:Peak metal Category:Sustainability Category:Environmental economics