User:CsCMRd/sandbox

| Company type | Open Joint Stock Company |

|---|---|

| Industry | Banking |

| Founded | 10 January 1992 |

| Headquarters | , |

Area served | Worldwide |

Key people | Jahangir Hajiyev, Chairman of the Board |

| Products | Consumer banking, corporate banking, finance and insurance, credit and debit cards |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 1,304 (June 30, 2013)[1] |

| Subsidiaries | IBA-Moscow, International Bank of Azerbaijan-Georgia |

| Website | www.ibar.az |

| History |

|---|

|

The International Bank of Azerbaijan is the state-controlled bank operating in the Republic of Azerbaijan. Headquartered in Baku, the bank consists of 36 branches and 95 service outlets in more than 40 cities.[2]

Within the South Caucasus region, IBA has the largest asset scope, customer base, and international business of all banks.[3] IBA has more than 30,000 corporate customers and 400,000 individual customers. Nearly all large and medium companies that have operations in Azerbaijan are IBA customers.[3]

Over 1,300 people work at IBA.[3] According to CISTRAN Finance, IBA is one of the world's 1,000 largest and most stable banks in 2013.[4] Jahangir Hajiyev joined the bank in 1995 as chairman of the Credit Committee and director of Credit and Investments. He has served as chairman since 2001.[5]

NEW

[edit]History

[edit]Early years

[edit]The bank began in 1990 as a branch office of Russian bank “Vneshekonombank” (RUS: Внешэкономбанк). In 1992, the office grew into a full joint-stock bank.[6]

In 1996, IBA founded the credit card processing company AzeriCard.[6]

The bank began relationships with both Visa and MasterCard in 1997, and the bank began issuing bank cards using those systems.[6]

Rapid growth

[edit]The few years after 2000 marked a period of growth and international recognition for IBA.

In 2002, the bank accomplished many growth initiatives, including:[6]

- Creating the Azerbaijani insurance company International Insurance Company, which remains the country's largest insurance provider (in terms of paid-in capital) as of October 2013;

- Opening two subsidiary banks in Russia and Georgia;

- Entering the World Economic Forum "Community of Growth Companies" as a full member;

- Offering American Express cards.

World stage

[edit]The IBA management team laid a foundation for growth in the 2000s. Chairman Hajiyev led the bank to international prominence, and by 2010, the bank was recognized as entering the world stage as a major player. The bank opened many international representative offices in the 2000s, including offices in the London, Frankfurt, Luxembourg, and Dubai.[6]

In 2009, the bank established an official presence in the United States of America with an office in New York.[6]

In 2010, IBA participated in the United Nations 7th Meeting of the Global Compact Working Group on the 10th Principle against Corruption.[7]

Financial

[edit]Q1-Q2, 2014

[edit]According to a report issued by the bank on July 1, 2014, IBA's assets increased over 25 percent during 2014 to over AZN 8 billion. Other updated financial figures included:[8]

- Loan portfolio: Increased 23.4 percent to AZN 5.5 billion.

- Individual loans: Totalled at AZN 563 million.

- Revenue: First the first two quarters of 2014, the bank made over AZN 330 million in revenue.

- Profit: Net profit for the first two quarters of 2014 was AZN 29.7 million.

2013

[edit]In 2013, the bank's assets increased to 7.17 billion AZN. On January 1, 2014, the bank's loan portfolio amounted to over 5 billion AZN. The loan portfolio dollar amount great by 30 percent between 2012 and 2013.[9]

Deposits

[edit]Deposits at IBA have increased 20.2% since the beginning of 2012. Total deposits amount to 1.165 billion manat.[10]

Dividends

[edit]In November 2012, shareholders voted to pay over 63 percent of undistributed profits as dividends. Approximately 8.6 million manat will be paid out as dividends. For 2009, 2010, and 2010, the bank's net profit amounted to 200.958 million manat. Revenues equaled 1.2 billion manat.[11]

Market position

[edit]As of July 1, 2012, IBA held the following sector positions:[12]

- 35% of banking market in Azerbaijan

- 30% of the loan portfolio market

- 35% of the total deposit portfolio

Moody's

[edit]On May 30, 2013, Moody’s Investors Service announced that it upgraded the bank’s outlook to “Stable” in the following ratings:[13]

- Long term foreign currency senior unsecured debt

- Long-term foreign currency subordinated debt

- Long-term local and foreign currency deposits

- Standalone financial strength

Performance

[edit]On April 22, 2013, the bank announced its key financial results for 2012:[14][15][16]

- Aggregate capital increased by 40% to AZN 720 million.

- Assets increased by 17.5% to AZN 5.891 billion.

- Authorized capital increased by 38% to AZN 331 million.

- Credit portfolio increased by 28.8% to AZN 4 billion.

- Loans to individuals increased to AZN 476 million.

- Net income increased by 80% to AZN 43.4 million.

- Revenue increased to AZN 377.8 million.

- Total capital increased by 78.3% to AZN 747 million.

Portfolio

[edit]The bank's portfolio information for 2012-2013 includes the following:

Assets

[edit]As of July 31, 2013, the bank’s assets amounted to AZN 6.42 billion. This figure amounted to an increase of over 25% over the prior year.[17]

Equity portfolio

[edit]See the Subsidiaries section above.

Financial audit

[edit]The bank’s primary auditor is Deloitte & Touche.[18]

Major loan activity

[edit]In 2012, IBA signed a 5-year bilateral loan agreement for US $145 million. The bank entered the Islamic financing market in 2013 with an initial investment of US $120 million.[6]

Total credit portfolio

[edit]The bank holds over 34 percent of the total credit portfolio in Azerbaijan.[19]

Corporate affairs

[edit]Board of Directors

[edit]IBA has four members on its Board of Directors:[20]

- Chairman: Jahangir Hajiyev

- First duty chairman: Emil Mustafayev

- Deputy chairman: Vagif Akbarov

- Deputy chairman: Gubad Huseynov

The board of the bank will remain in office until July 2015.[21]

Headquarters

[edit]The bank is building a new headquarters building that will be commissioned in 2014. The current headquarters is located in the central area of Baku.[22][23]

Ownership

[edit]The Azerbaijan Ministry of Finance is the bank’s main shareholder, possessing a 50.2 percent equity stake.[24] The bank holds 40 to 50 percent of the Azerbaijan banking system’s total assets. Of the largest 10 banks in Azerbaijan, the bank holds 44.2% of assets, 47.6% of loans, 15.7% of retail loans, 39.4% of deposits, 30.5% of capital and 44.3% of banking sector profits.[25]

Services

[edit]Corporate customer services

[edit]The bank offers various types of bank accounts for business customers.[26]

Business loans

[edit]The bank offers a number of business loans, including business project financing, loans syndication, and long-term loans.[26]

Currency exchange

[edit]IBA buys and sells various currencies by offering a currency exchange.[26]

E-commerce

[edit]The bank works with business customers to set up e-commerce services on the business’ website. The e-commerce system allows customers to use a Visa or MasterCard to buy merchandise and services online.[26]

InternetBank

[edit]The bank’s full-service online banking system is called InternetBank.[26]

Salary card

[edit]The bank also offers businesses and their employees a “salary card.” An employer puts money onto the card for an employee’s salary, bonuses, and any other types of pay.[26]

Settlement services

[edit]The bank offers a suite of corporate banking services called “settlement services.” The services includes accounts that use more than one currency, "salary cards,” cash deposits and withdrawal, money transfers and online account management.[26]

Individual customer services

[edit]Individual customers can get a MasterCard, Visa and American Express card through the bank.[27] To date, the bank has issued over 2.5 million bank cards to customers.[9]

The bank also provides “micro-loans,” which are loans up to 5,000 manat for customers age 20-65. Individuals can also apply for regular short-term and long-term personal loans.[27]

Individual customers can do online banking with IBA’s InternetBank system. Customers can pay bills online to various Azeri companies like Aztelekom, Azercell, Alfanet, and AzEuroTel. Customers can also set up automatic, recurring monthly payments. Customers can also make online purchases through the WebMoney, a service similar to PayPal.[27]

For retired customers who receive pensions, the bank offers a service called Pension+. The bank gives interest-free loans of 100 manat or more. Repayments for the loan are made automatically when the customer gets their next pension deposit. Additionally, the IBA offers safety deposit boxes.[27]

Private Banking

[edit]The bank runs a private banking service for wealthy individuals called “Prestige Club,” a personal banking service aimed at wealthy customers. IBA started the service in 2011.[28] Members of the club get personal assistance with all areas of life, such as business, leisure, travel, home and family.[29]

In 2012, the growth in deposits at IBA-Moscow was mostly due to deposits made by members of the Prestige Club; these deposits accounted for 73 percent of the total growth in customer deposits.[30]

In late 2013, the bank’s Russian branch, IBA-Moscow, started a service called the Multi-Family Office Prestige Club. The service provides private banking services such as consulting, tax and investment help.[31] Fagan Naghiyev serves as the head of Prestige Club Private Banking at IBA-Moscow.[32]

The bank has described Prestit as a personal banking service “designed to organize all processes in all areas of life” such as business, property, inheritance, and travel.[33][34] Some of the services are only available for people who have over $50,000 USD in their account.[35]

Operations

[edit]Customer initiatives

[edit]Although the bank offers many programs, the R@ndevu service and "Pension ATM" program have received media attention:

R@ndevu

[edit]The bank offers customers a service known as “R@ndevu.” The service helps customers get appointments at branches without waiting in line. To do so, customers make appointments online or through the phone.[36]

To run the program, the bank procured a “queue management system” known as eSirius produced by a French company called ESII.[37]

Pension ATMs

[edit]IBA is one of the banks that manages Azerbaijani pensions. In 2013, IBA will roll out new ATMs that people can use to draw out their pensions more easily.[38]

Investment management

[edit]The bank maintains a balanced portfolio of investment companies:

Construction

[edit]The bank has also financed Akkord Industry Construction Investment Corporation, an Azeri construction company.[39]

Energy

[edit]IBA has played a significant financial role with the State Oil Company of Azerbaijan (SOCAR). In 2011, total liabilities of SOCAR to IBA amounted to 680 million manat.[40]

Manufacturing

[edit]In June 2012, it was reported in the Azeri-Press News Agency that the bank has financed construction of a weaving factory in the United Arab Emirates.[41]

Methanol

[edit]IBA has provided capital financing to AzMeCo, an Azerbaijani methanol production company. In November 2012, AzMeCo signed a contract with BP for the sale, purchase and marketing of methanol produced at the AzMeCo plant in Azerbaijan. The process will begin in 2013.[42]

The cost of the plant construction will be US$360 million.[42]

Mining

[edit]Gold mining company Anglo-Asian Mining PLC got $30 million from IBA to construct an “agitation leaching plant.” IBA has provided Anglo-Asian Mining with a letter of intent that states the bank may provide up to an additional $42 million. The company will build the plant on the Gadabay gold and copper mine[43]

International operations

[edit]In May 2008, the bank became the Azerbaijan source for the issuance of Eurobonds and American Express credit cards.[44] In July 2008, the bank received permission from the U.S. Federal Reserve Board to open a representative office in New York City.[45] The bank is expanding internationally. In the first six months of 2012, direct investment into Azerbaijan increased to $2.2 billion, which was a 27 percent increase over the same period a year earlier.[46]

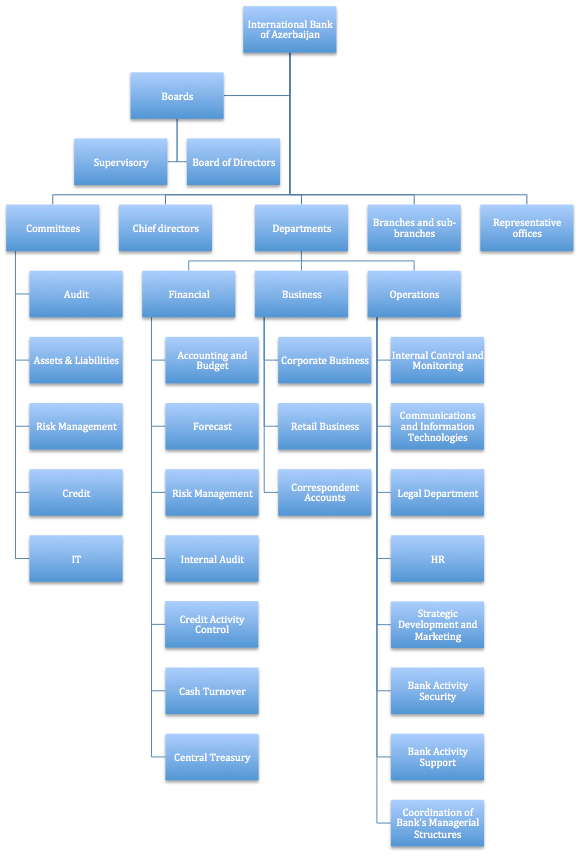

Organizational structure

[edit]The bank is structured around a boards, committees, departments, branches and sub-branches, representative offices and the bank's chief directors.[47]

Syndicated Murabaha financing entity

[edit]As of April 2013, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) had approved the International Bank of Azerbaijan as a certified Islamic banking institution. IBA is now the only bank in Azerbaijan with the certification by AAOFI.[48]

History

[edit]On July 21, 2013, it was reported that Barwa Bank, Emirates NBD Capital Limited, J.P. Morgan Limited, and Noor Islamic Bank PJSC invested $120.5 million (U.S. dollars) into and created a syndicated Murabaha financing entity for the IBA.[49]

Definition

[edit]According to Investopedia, Murabaha is a loan that does not charge interest; instead, an intermediary holds ownership of the property until the buyer pays off the loan.[50]

Azerbaijan's importance in the market

[edit]In October 2012, Azer News reported that Azerbaijan is becoming a regional center for Islamic financing. According to the article, "Islamic financing is one of the fastest-growing segments of the global financial services industry worldwide. The International Bank of Azerbaijan (IBA), the country’s leading bank, has recently established an Islamic banking department..."[51]

Program offerings

[edit]The bank offers Murahaba (transactions with precious metals), Mudaraba (deposit transactions), Vakala (financial services), Icara (leasing), and Qard-al-Hasan (customer service).[51]

The IBA would use proceeds from the entity to finance its line of Shariah-compliant loans.[52]

Qibla

[edit]In 2013, IBA created a credit and debit card geared toward Islamic customers. The card, known as Qibla, has a digital compass that points to Mecca.[53]

Subsidiaries

[edit]The bank owns several subsidiaries which include direct subsidiary banks of IBA and non-banking sector companies.

IBA-Georgia

[edit]International Bank of Azerbaijan-Georgia is a subsidiary bank of IBA in Tbilisi, Georgia, founded in 2007.[54] The bank offers depository and commercial banking. Services include currency exchange, money transfer, deposits, and credit.[55]

IBA-Georgia is a member of the Tbilisi Interbank Stock Exchange, Association of Banks of Georgia, and the Banking Association for Central and Eastern Europe. As of the end of 2010, earning assets increased by 35% over the year. Revenues and profits increased by 104% and 87% respectively.[56]

IBA-Moscow

[edit]IBA-Moscow is a subsidiary bank of the IBA in Moscow, Russia, that was started in 2002. The primary purpose is to deepen trade and economic ties between Russia and Azerbaijan and to provide services to Azerbaijani citizens who live in Russia. The bank is located at 125009, Moscow, ul. Tverskaya, 6, str. 2.[57]

Non-banking sector investment companies

[edit]These investments include:

- Akkord Industry Construction Investment Corporation

- AzeriCard Ltd.

- AzMeCo

- AzQTel

- Inter Glass

- International Insurance Company

Technology

[edit]The bank is implementing a new ATM management system. Naumen Service Desk, which is a subsidiary of Naumen Company, is developing the system for IBA. Naumen is a software developer based in Russia.[58] IBA and Naumen are leading Azerbaijan toward implementation of virtualization technology across multiple industries.[59]

Public affairs

[edit]Awards and recognition

[edit]The bank has received awards and recognition from organizations around the world. Some of these include the following:

Best Bank in Azerbaijan

[edit]IBA was named the Best Bank in Azerbaijan by Global Finance magazine[a] in 2012 and 2014. The criteria for winning included assets growth, profitability, strategic development, customer service, competitive advantages and innovative products. Global Finance describes the rankings: "The winners are not always the biggest banks but rather the best—those with the qualities that corporations should look for when choosing a bank. These are banks with effective risk management systems, quality service and best practices in corporate governance."[61][60]

Best Local Bank

[edit]In May 2013, the bank was named “Best Local Bank” by EMEA Finance magazine. Each year, EMEA Finance gives “best bank” awards to banks in more than 20 different categories.[62]

Investment Angel

[edit]In 2011, at the International Banking Conference of CIS, the International Organization of Creditors awarded IBA with the Investment Angel award.[63]

Top 200 in Eurasia

[edit]In 2012, IBA was ranked number 38 in "Top 200 Banks in Eurasia" by Business New Europe magazine. IBA is the only bank from Azerbaijan included on the list.[64]

World's Best Emerging Market Banks

[edit]In 2012, Global Finance magazine named IBA as one of the World’s Best Emerging Market Banks in Asia.[65]

Community involvement

[edit]In 2012, IBA began sponsoring an annual youth soccer tournament each summer. In 2013, the tournament will be held at Shafa Stadium from June 17–22. In 2012, 130 children from youth teams of professional soccer clubs in 8 countries attended. The countries were Azerbaijan, Turkey, Georgia, Sweden, Russia, Bulgaria, Ukraine and Estonia.[66]

Cross-promotions

[edit]The bank runs a promotion with Visa, Inc. called “'Pay by card Visa abroad and win a prize!” The bank gives prizes such as iPhones to customers who use their credit card outside of Azerbaijan.[67] In 2013, the bank partnered with Azercell and Visa for a joint promotion. The promotion gave free cell phone minutes to customers if they pay their cell phone bill with an IBA Visa debit card.[68]

Memberships

[edit]IBA is a member of the following professional organizations and systems:[69]

- Azerbaijan Banks Association (ABA)

- Baku Interbank Currency Exchange (BICEX)

- Baku Stock Exchange (BSE)

- Society for Worldwide Interbank Financial Telecommunication (SWIFT)

- International payment system MasterCard International

- International payment system VISA International

- International payment system American Express

- International information system Reuters

- Banking Association for Central and Eastern Europe (BACEE)

- Global Growth Companies Community (GGC)

- World Economic Forum (WEF)

Partnerships

[edit]Some prominent businesses and organizations that have partnered with IBA include the following:

American Express

[edit]On November 3, 2012, it was reported that the IBA and American Express have signed an exclusive cooperation deal. "According to the International Bank of Azerbaijan, this agreement will become a new step in the development of relations between International Bank of Azerbaijan and American Express."[70]

Baku stock exchange

[edit]IBA also holds a 47.6% ownership interest in Joint Leasing Closed Corporation and a 20% ownership interest in Baku Interbank Stock Exchange.[71] Joint Leasing has 30 percent of the leasing market share in Azerbaijan, and its portfolio is valued at around $44 million.[72]

MasterCard

[edit]In April 2013, IBA began issuing MasterCard debit cards. The debit card lines include standard MasterCard, MasterCard gold, and MasterCard platinum.[73]

Microsoft

[edit]In 2013, IBA and the Microsoft Corporation signed a long-term enterprise agreement. The agreement allows IBA to use Microsoft software on its computer systems.[74]

Privatization

[edit]While the International Monetary Fund (IMF) has continued to push for privatization of the bank, Vahid Akhundov, who is the Azerbaijan State Councilor for Economic Issues, has said that state-owned banks have a legitimate role in Azerbaijan and in other countries. Mr. Akhundov has also acknowledged that the existence of IBA as a state-owned bank has eliminated past problems.[75]

Notes

[edit]References

[edit]- ^ a b c d e f "Investor's Presentation, First Half of 2013", IBA semi-annual investor reports, Baku, Azerbaijan: International Bank of Azerbaijan, 2013

{{citation}}: Missing or empty|title=(help) - ^ “International Bank of Azerbaijan,” U.S.-Azerbaijan Chamber of Commerce

- ^ a b c “Proposed Subordinated Loan; Republic of Azerbaijan: International Bank of Azerbaijan”, Asian Development Bank website, accessed 16 Mar 2013

- ^ Barron, Lisa (24 September 2013). "International Bank of Azerbaijan listed as one of the world's largest". CISTRAN Finance. Retrieved 24 September 2013.

- ^ [1], The Business Year, 2011

- ^ a b c d e f g "Investor's Presentation, First Half of 2013", IBA semi-annual investor reports, Baku, Azerbaijan: International Bank of Azerbaijan, 2013

- ^ United Nations Global Compact, accessed 16 Mar 2013

- ^ "International Bank of Azerbaijan assets jump by 25%" (Press release). International Bank of Azerbaijan. 17 July 2014. Retrieved 24 July 2014.

- ^ a b "International Bank of Azerbaijan’s assets increased by 22%, capital by 25.5%, net profit by 17.3%" (Press release). Baku, Azerbaijan: International Bank of Azerbaijan. 2014-02-03. Retrieved 2014-02-05.

- ^ “Since the Beginning of 2012, Deposits at IBA Increased by 20%”, International Bank of Azerbaijan website, 20 Dec 2012

- ^ "Azerbaijani largest bank to transfer 63 percent of undistributed profit for paying dividends", Trend.az, 30 Nov 2012

- ^ A. Akhundov, “Privatization of Azerbaijan’s Largest Bank Removed From Agenda,” Trend News Agency, 13 Dec 2012

- ^ E. Aliyev, “Moody's improves outlook on ratings of largest bank of Azerbaijan”, Trend News Agency, 30 May 2013, Accessed 03 June 2013

- ^ “Assets of International Bank of Azerbaijan increased by almost 20%”, News.az, 22 Apr 2013, Accessed 22 Apr 2013

- ^ “IBA’s assets increases 17.5 per cent”, AzerNews, 25 Jan 2013, accessed 16 Mar 2013

- ^ "International Bank of Azerbaijan's net income increases by 80 percent", Trend Capital, 24 Jan 2013, accessed 15 Mar 2013 via Nexis

- ^ ” Aggregate Capital of International Bank of Azerbaijan Raised by 61%”, Economic News (Information Agency Oreanda), July 31, 2013. (Retrieved via Nexis August 15, 2013).

- ^ “Audit of MBA trusted to Deloitte & Touche”, Turan Information Agency, August 14, 2013. (Retrieved via Nexis August 15, 2013).

- ^ “The share of overdue loans in total lending has fallen to 5.7%”, Turan Information Agency, August 15, 2013. (Retrieved via Nexis August 15, 2013).

- ^ “Management”, International Bank of Azerbaijan website

- ^ "New staff approved at International Bank of Azerbaijan", Trend.az, 30 Nov 2012

- ^ “The new building for the International Bank of Azerbaijan”, ENP Newswire, 04 Apr 2013, Accessed 17 Apr 2013 via Nexis

- ^ “International Bank Opens Brand New Building”, Economic News (Information Agency Oreanda), 16 Apr 2013, Accessed 17 Apr 2013 via Nexis

- ^ “Rapid growth but weak governance in the banks,” New Europe: The European Weekly, May 5, 2008

- ^ Lyndsay C. Howard, “Making the Best of a Crisis”, Swiss Style Magazine, 2011

- ^ a b c d e f g “For corporate customers”. International Bank of Azerbaijan. Retrieved 29 January 2014.

- ^ a b c d “For individual customers”. International Bank of Azerbaijan. Retrieved 29 January 2014.

- ^ "IBA-Moscow licensed for brokerage activities". Azeri-Press News Agency (APA). 27 June 2012.

- ^ "Bank IBA-Moscow's Prestige Club opens a new office". ABC.Az. 28 January 2013. Retrieved 5 March 2014.

- ^ "IBAR-New office of the Prestige Club of 'IBA-Moscow' Bank". ENP Newswire. 30 January 2013.

- ^ Barron, Lisa (19 December 2013). "MBA-Moscow announces new private banking service". CISTRAN Finance. Retrieved 5 March 2014.

- ^ "Bank IBA-Moscow obtains bond rating at level of parent bank's rating first time on market". ABC.Az. 28 March 2013. Retrieved 5 March 2014.

- ^ "Bank IBA-Moscow’s Prestige Club opens a new office". ABC.Az. 2013-01-28 (Retrieved 2014-02-17).

- ^ "IBA-Moscow presented package of investment-banking services PRESTIGE CLUB". ABC.Az. 2011-03-11 (Retrieved 2014-02-17).

- ^ "IBA-Moscow launched PRESTIGE CLUB, a new line to VIP customer services". Noodls. 11 November 2011. Retrieved 5 March 2014.

- ^ ”International Bank of Azerbaijan launches 'R@ndevu' service”, Azeri-Press Agency (APA), August 7, 2013. (Retrieved via Nexis August 15, 2013).

- ^ ” The International Bank of Azerbaijan has introduced a new service R @ ndevu”, ENP Newswire, August 6, 2013. (Retrieved via Nexis August 15, 2013).

- ^ A. Akhundov, “Access to pension problems in Azerbaijan completely solved in 2013”, Trend Daily Economic News, 30 Nov 2012

- ^ “Azerbaijani President attends opening of new production line of Gazakh Cement Plant", Azeri-Press Agency (APA), July 5, 2013. (Retrieved July 30, 2013).

- ^ Alex Ferreras, “International Bank of Azerbaijan Remains Largest Creditor of SOCAR”, LoanSafe.org, 30 Jul 2012

- ^ "International Bank of Azerbaijan finances construction of large establishment in UAE," Azeri-Press News Agency, June 14, 2012

- ^ a b "IBAR - International Bank of Azerbaijan : Azerbaijani methanol production company signs contract with BP", 4-traders.com, 26 Nov 2012

- ^ A. Akhundov, “Up to $54mln Required to Build New Gold Processing Plan in Azerbaijan,” Trend Capital, 22 Dec 2012

- ^ “Sovereign Eurobonds to be secured by IBA,” New Europe: The European Weekly, May 12, 2008

- ^ “International Bank of Azerbaijan, Baku, Azerbaijan: Order Approving Establishment of a Representative Office,” Federal Reserve System, July 2008

- ^ Zulfugar Agayev, "Azeri Foreign Direct Investment Grows 27% in First Half of Year," Bloomberg, 24 Aug 2012.

- ^ Organizational Structure Of IBA, International Bank of Azerbaijan website (Retrieved 2014-02-18)

- ^ “Islamic banking products to the International Bank of Azerbaijan passed international certification”, ENP Newswire, 09 Apr 2013, Accessed 17 Apr 2013 via Nexis

- ^ [URL "US$ 120.5 million Syndicated Murabaha Financing Facility for Int'l Bank of Azerbaijan"], ''Emirates News Agency'', July 21, 2013 (Retrieved July 22, 2013)

- ^ "Murabaha", Investopedia (Retrieved July 22, 2013)

- ^ a b Seymur Aliyev, "Azerbaijan becoming regional center of Islamic banking", Azer News, 10 Oct 2012

- ^ [URL "US$ 120.5 million Syndicated Murabaha Financing Facility for Int'l Bank of Azerbaijan"], ''Emirates News Agency'', July 21, 2013 (Retrieved July 22, 2013)

- ^ Waits, Douglas (4 October 2013). "IBA: Islamic banking has strong future in Azerbaijan". CISTRAN Finance. Retrieved 4 October 2013.

- ^ “Company Overview of JSC International Bank of Azerbaijan – Georgia”, Businessweek

- ^ “Company Overview of JSC International Bank of Azerbaijan – Georgia,” Businessweek

- ^ "Income of IBA-Georgia has increased by 104%", EPN Newswire 20 April 2011

- ^ “The Bank IBA-Moscow”, Banki.ru LLC news agency

- ^ H. Valiyev, “Azerbaijan's largest bank introduces centralised ATM management system”, Trend Daily Economic News, 11 Apr 2013, Accessed 22 Apr 2013 via Nexis

- ^ Nigar Orujova, “Azerbaijan sees virtualization technology boom: expert”, AzerNews, 12 Apr 2013, Accessed 22 Apr 2013

- ^ a b "IBA recognized as the best bank in Azerbaijan by Global Finance magazine". ABC.AZ. Baku, Azerbaijan: Fineko Informational & Analytic Agency. 7 April 2014. Retrieved 7 April 2014.

- ^ Thomas Clouse, Jonathan Gregson, Antonio Guerrero & Gordon Platt, "World's Best Banks 2012; Seeking Stability," Global Finance magazine, May 2012

- ^ “IBA named “Best Local Bank” by EMEA Finance magazine”, AzerNews, 29 May 2013, Accessed 3 June 2013

- ^ “International Bank of Azerbaijan Awarded with ‘Investment Angel’ Prize”, The Ministry of Culture and Tourism of Azerbaijan website, 12 Jan 2011

- ^ “IBA is one of the biggest banks of the CIS”, Azeri-Press News Agency (APA), 3 Dec 2012

- ^ Andrea Fiano, banks/11675-worlds-best-emerging-market-banks-in-asia-2012.html#axzz2GSvINlmf “Global Finance names the World’s Best Emerging Market Banks 2012 in Asia”, Global Finance, 20 Mar 2012

- ^ “The International Bank of Azerbaijan will hold an international tournament II of young players IBA-Cup 2013”, ENP Newswire, 5 Apr 2013, Accessed 22 Apr 2013 via Nexis

- ^ ” The International Bank of Azerbaijan and VISA have launched a new campaign”, ENP Newswire, August 6, 2013. (Retrieved via Nexis August 15, 2013).

- ^ Douglas Waits, "International Bank of Azerbaijan launches new promotional campaign with Azercell, Visa", CISTRAN Finance, 9/13/13. (Retrieved 9/23/13).

- ^ “About Bank”, International Bank of Azerbaijan website

- ^ "Azerbaijan, United States: IBA Inks Exclusive Cooperation Deal with American Express”, TendersInfo.com, 3 Nov 2012

- ^ “Bank’s Subsidiaries and Affiliates”, International Bank of Azerbaijan website

- ^ "Joint Leasing has raised external funding for $2 million in 2014" (Press release). Baku, Azerbaijan: International Bank of Azerbaijan. 2014-01-14. Retrieved 2014-02-05.

- ^ “International Bank of Azerbaijan has expanded its range of plastic cards”, ENP Newswire, 19 Mar 2013, Accessed 17 Apr 2013 via Nexis

- ^ Vahab Rzayev, “International Bank of Azerbaijan signs long-term cooperation agreement withMicrosoft Company”, Azeri-Press News Agency (APA), 17 Apr 2013, Accessed 17 Apr 2013 via Nexis

- ^ Ali Ahmedov, “State Councilor: Azerbaijani government is committed to privatization ofInternational Bank of Azerbaijan”, Azeri-Press News Agency (APA), 17 Apr 2013, Accessed 17 Apr 2013 via Nexis

External links

[edit]