User:Jalen082103/sandbox

U.S Inflation Through The Years

This article is about the rate inflation has risen throughout the years in the United States.

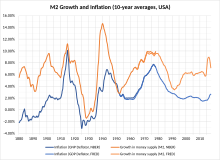

The rate at which prices increase over a specific time period is known as inflation. It is often measured in broad terms, such as the general rise in prices or the rise in a nation's cost of living. In the United States Inflation has risen 2.37% in the past 10 years.[1] Demand-pull, cost-push, and inflation expectations are the three basic sources of inflation that can be categorized simply.[2] Another cause for the recent rise in prices is the Monetary policy a policy set to control interest rates in the United States. [3] The government has recently passed the Inflation Reduction Act to help combat the high cost of living in the Nation.[4]

Past Years

[edit]

The average annual inflation rate was 3.8% from 1960 to 2021. The whole price increase was 829.57 percent. At the start of 2022, something that cost $100 in 1960 would cost $929.57. The annual inflation rate for October 2022 was 7.7% This includes the price of water and electricity going up 17.6% and Food going up 12.4%.[5] The Average price of a paperback Novel has risen from 10 cents to 10 dollars from the start of the 20th century to 2011. [6] Following the COVID-19 pandemic in 2022, inflation hit 8.5%, its highest level since 1982.

Sources Of Inflation

[edit]The 3 most simplified sources of inflation are Demand Pull, Cost-Push, and Inflation expectations . Demand pull refers to When there is a lack of supplies and there is a demand-pull inflation, too much money is being spent to buy too few items.[7] For instance, if producing tires suddenly costs twice as much, the cost of those tires will double as well, leading to inflation. Since manufacturers will have to spend more money to finish their vehicles, this may potentially have an impact on the auto market. Cost Push refers to When overall prices rise as a result of rising costs for wages and raw materials, this phenomenon is referred to as cost-push inflation, also referred to as wage-push inflation. The total amount of production in the economy may decline as a result of higher manufacturing costs.[8] For instance, it's feasible that the owner of a firm will simply shut down the operation if low-paid workers at the facility organize a union and demand higher salaries. Inflation Expectations is The rate at which people—consumers, corporations, and investors—expect prices to grow in the future.[9] They are significant because real inflation is influenced by our expectations in part. Businesses will want to raise prices by lets say 5 percent, and employees and their unions will seek raises of a comparable proportion if everyone anticipates price increases of 5 percent during the upcoming year.

Monetary Policy

[edit]Controlling the amount of money in an economy and the channels through which it is provided is known as monetary policy. GDP, inflation, and industry- and sector-specific growth rates are examples of economic indicators that have an impact on monetary policy. Price stability is the main goal of monetary policy. In order to promote sustainable economic growth, the general price level in the domestic economy must stay as low and stable as feasible in order to achieve the goal of price stability. Money supply in an economy is impacted by monetary policy, which in turn affects interest rates and inflation. Additionally, it affects employment, net exports, business expansion, debt costs, and the relative costs of saving vs spending, all of which directly or indirectly affect aggregate demand.[10]

Inflation Reduction Act

[edit]

This new legislation reduces the price of prescription drugs, increases taxes on companies, and represents the greatest investment in climate change prevention in American history. The Inflation Reduction Act's most important feature allows Medicare to negotiate the cost of some prescription drugs, lowering the cost that recipients will pay for their medicines. Beginning in 2025, Medicare participants will be entitled to a $2,000 yearly out-of-pocket prescription drug cost cap. The bill also includes several climate-related initiatives, such as tax credits for households to reduce energy costs, investments in generating power, and carbon-reduction tax credits.[11]

References

[edit]- ^ "Database, Tables, And Calculators By Subject". U.S Bureau Of Labor Statistics.

- ^ "Causes of inflation". Reserve Banks Of Australia.

- ^ DE WITTE, MELISSA (SEPTEMBER 6, 2022). "What causes inflation? Stanford scholar explains". Stanford.edu.

{{cite web}}: Check date values in:|date=(help) - ^ "Inflation reduction act statement". thesolutionsproject.org. August 18,2022.

{{cite web}}: Check date values in:|date=(help) - ^ "Inflation rates in the United States of America".

- ^ "By the Numbers: Inflation". InfoBase.com.

- ^ Chen, James (September 14, 2022). "What is Demand Pull Inflation".

- ^ Kenton, Will (March 7, 2022). "Cost Push Inflation: When It Occurs, Definition, and Causes".

- ^ "Inflation Expectations".

- ^ Balakrishnan, Ravi (2006-07-01). U.S. Inflation Dynamics : What Drives Them Over Different Frequencies?. International Monetary Fund.

{{cite book}}: CS1 maint: year (link) - ^ Anne Smith, Kelly (August 23, 2022). "The Inflation Reduction Act Is Now Law—Here's What It Means For You". Forbes.com.