User:Seaplant/sandbox

Appearance

| This is a user sandbox of Seaplant. You can use it for testing or practicing edits. This is not the sandbox where you should draft your assigned article for a dashboard.wikiedu.org course. To find the right sandbox for your assignment, visit your Dashboard course page and follow the Sandbox Draft link for your assigned article in the My Articles section. |

Short description of my Practice Experience

[edit]I will be working with both the California Senate Office of Research and the California Senate Human Services Committee, on public policy research.

Contributions (see also Special:Contributions/Seaplant)

[edit]Sector:

- CalWORKs

- Created "Effects" section

- Greatly expanded "History" section (added all except 1st sentence and a half)

- Created "Federal Influence" section

- Expanded "Eligibility" section into "Eligibility and Benefits"

- Welfare in California

- added section "Overall Reductions in Poverty Rate"

Area:

- Indigenous peoples of California

- Added pointer to information about the relationship between State, Federal, and Tribal governments regarding Tribal TANF programs, which I added at CalWORKs#First_Nations_and_CalWORKs.

- Clarified and expanded the current demographic data in"21st Century" section

- Demographics of California

- added section on "Income and Socioeconomic Factors"

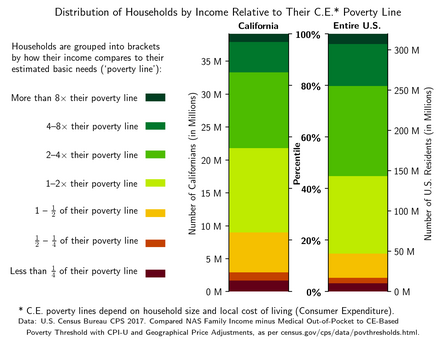

- created and added a graphic showing California's distribution of household incomes relative to CE-adjusted poverty lines.

Summarizing and Synthesizing

[edit]Governance and Sovereignty of Indigenous peoples of California (Area: California):

[edit]- Expanding section #21st Century to include information on the relationships between Tribal, State, and U.S. Federal governance over native people, or possibly replacing it with "Demographics" and "Governance". Much of this information could also go on the TANF and CalWORKs pages, whither the Indigenous peoples of California#21st Century could link.

- Population size

- 723,000 identifying an "American Indian or Alaska Native" tribe as a component of their race (14% of the nation-wide total). This population grew by 15% between 2000 and 2010, much less than the nation-wide growth rate of 27%, but higher than the population growth rate for all races, which was about 10% in California over that decade. [1]

- Relationship to welfare programs

- The U.S. Federal Temporary Assistance for Needy Families (TANF) program offers funding to States, and Federally recognized native tribes, to create social welfare programs for families. Although states and tribes have freedom in how they implement the program, key aspects are mandated: most parents receiving benefits are required to participate in work or training/preparation activities for at least 20 hours per week (making this a form of workfare), recipients have a lifetime cap of 60 months receiving benefits, and states/tribes are required to contribute a certain amount of their own funding, among others.[2][3] Outside of tribal lands, California's TANF program is CalWORKs, which receives $2.4b from TANF and $2.1b in State funds.[4] The State of California also provides funding to supplement the TANF grants received by tribes located within the State. This is allotted based on the number of families receiving benefits from each Tribal TANF program. For Federally recognized tribes that do not implement TANF programs, county CalWORKs administrators are required to make CalWORKs benefits available. Members of unrecognized tribes are treated by the counties as residents, and so can receive CalWORKs as well.[5]

- [Plan: add information on the relationship with Child Services (DCFS) and foster care (include ICWA)]

- Population size

Welfare in California (Sector: Public Policy):

[edit]- Political context and dynamics

- CalWORKs

- Historic and federal influence on generosity: The generosity or austerity of CalWORKs is to some degree determined by Federal legislation: TANF's introduction in 1996 brought work requirements that were stricter than those of the AFDC program it replaced, and a new cap on individuals' lifetime benefits.[6] While these requirements for participants were stricter, TANF did give more freedom to states to design their implementations of the program than they had with the AFDC.[7] The California Legislature initially created CalWORKs to be more generous than many other states' TANF implementations, but has since reformed it to be generally more austere. The lifetime benefit cap, for example, was initially set at 60 months but was reduced in 2011 to 48 months, and split in 2012 so that partial restrictions applied after 24 months. [6]

- Effects of generosity/austerity: The effects of such reductions in benefits are of course varied and complex. California conducted a controlled experiment of a 15% reduction in maximum benefits (as well as other reductions) of the AFDC program beginning in 1991 that illustrates some of these impacts. After 7 years, the employment rates and average wages were somewhat higher for AFDC recipients who had been placed in the reduced-benefit program than in the control group. This could be explained by participants having a greater need for employment income when their benefits are smaller. The average disposable incomes (including wages and benefits) for the reduced-benefit group stayed approximately equal to that of the control group, however, as increases in wages made up for decreases in benefits. This disposable income (for both groups) remained well below the poverty line.[7]

- WPR: The State has considerable freedom in how to spend their Federal funds, but risk a reduction in funding unless at least 50% of families receiving monthly payments meet work or job training requirements. Specifically, to be counted toward this Work Participation Rate (WPR), parents must perform 30 hours per week (20 for single parents with a child under 6) of work, or work-related activities such as job training, job search assistance, or community service. In 2017, California had a WPR of 61%, thanks mainly to the 52% of recipients of federal money who had unsubsidized employment.[3]

- State response to WPR: The State has responded to accountability to Federal work participation requirements in several ways. Governor Jerry Brown proposed reforms—enacted in 2012—to require recipients to be engaged in Federally-approved work activities after the first 24 months of aid (during which time a more flexible set of work activities is available). This change was also intended to decrease the time recipients spend in the program, hence cutting costs at the same time as guarding against a reduction in Federal funding. The State also extends this accountability to the counties through a policy of decreasing funding to counties that don't meet the Federal rate in the event that the State as a whole receives a penalty. The State further requires CalWORKs recipients, along with their caseworker, to construct plans for beginning work-activities as soon as possible. [8][6]

- CalWORKs

- Efficacy and recipients' perspective

- CalWORKs

- Efficacy—comparison to other states: As far as can be determined from Census (CPS) data, CalWORKs achieves similar effects for low-income families as programs in comparable states. Specifically, no significant differences were found in poverty rates, unemployment rates, TANF (CalWORKs) enrollment rates, or education/training enrollment rates when comparing likely CalWORKs-eligible families.[9]

- Usage patterns: Only 50% of CalWORKs recipients are still enrolled one year after they first entered the program, and only 33% remain past two years. Two years after they first enrolled, the average recipient has used only 9 months of benefits.[9]

- Workfare from participants' perspective: Conditioning the provision of welfare benefits on work requirements increases the burdens on families trying not to 'fall through the cracks' between safety net programs. Even without work requirements, families face application processes for the various separate welfare programs in California that require considerable time, effort, and diligence—and often yield one or more rejections. Work requirements are an additional burden in that process as well as barrier rejecting more families from receiving CalWORKs aid, whether intentionally (e.g. for a parent who is choosing not to work) or unintentionally (e.g. for a parent that is unable to meet the requirements). Workfare policies also add burdens to those who do receive aid, which again are unintentional in some cases, such as parents left unemployed by a contraction in the labor market being required to apply for weekly quotas of (scarcely available) jobs or attend job-readiness classes. These differences between welfare programs without work requirements and workfare programs like CalWORKs that are inter-connected with the labor market make workfare programs less able to aid parents that are already doing as much as they can to secure jobs that would provide sufficient income. This creates what Eva Bertram describes as "a three-sided trap, defined by a lack of assistance for the nonworking poor, inadequate support for those in low-wage jobs, and few exits from the low-wage sector to middle-class jobs."[10] Other researchers have identified as a cause for concern the decreased time CalWORKs participants are able to spend parenting their children due to increased time working in the formal sector instead. [11]

- more participants' perspective: Despite these hardships associated with welfare-to-work programs, CalWORKs is generally viewed favorably by participants. In particular, the job search components are viewed as helpful in obtaining a job for unemployed participants. Indeed, 91% of those leaving the program in 2001 were currently employed, and 97% had been employed at some point while enrolled. The majority of those staying in the program or returning after a brief period not enrolled had been employed while in the program as well. While CalWORKs seems to be effective at getting participants some employment, the quality of that employment is a bigger challenge. The large number of participants who are employed and receiving benefits at the same time illustrate that neither CalWORKs' benefits nor their wages are alone sufficient to meet their family's needs. Indeed, most of those with jobs have extremely low wages (well below their poverty thresholds on average) and little opportunity for advancement. Participants identified a lack of support from CalWORKs for improving inadequate employment or for maintaining employment once hired. In short, unemployed parents in search of jobs are often able to gain employment through CalWORKs, but that does not translate directly to earning sufficient income to meet their family's needs. [11]

- Overall

- Efficacy—comparison to hypothetical without programs: While the long-term effect of these programs on California as a whole is multi-faceted, the immediate effect on those receiving aid is easier to quantify. The resources available to each Californian (i.e. their income, accounting for taxes and benefits such as medical care) can be compared to an estimate of the resources required to meet their basic needs (a poverty threshold varying based on factors such as family size and local cost-of-living) to label them as “in” or “out” of poverty, and thus determine a poverty rate for the state. Several such measures are calculated, including the Census Bureau’s Supplemental Poverty Measure (SPM) and the Public Policy Institute of California’s California Poverty Measure (CPM). The current CPM poverty rate is 20%, but if welfare benefits were excluded from the estimates of families’ resources that would rise to 28%. In other words, one third of the people who would be in poverty if welfare programs didn’t exist are raised “out” of poverty by welfare programs. [12]

- CalWORKs

- About a quarter of that effect (2 percentage points reduction in the CPM poverty rate) is due to CalFresh, and another quarter is due to earned income tax credits (the federal EITC and the new CalEITC). A 1 percentage point reduction (about 380,000 Californians) is attributable to CalWORKs. [12] Similar effects are achieved by nation-wide programs. Using the SPM, tax credits achieve a 2.5 percentage point reduction in the poverty rate, and SNAP (of which CalFresh is a part), SSI, and housing subsidies each achieve a 1 percentage point reduction (about 3,300,000 U.S. residents each). Only a 0.2 percentage point reduction in poverty is attributed to TANF (of which CalWORKs is a part). [13]

Demographics of California (Area: California):

[edit]- The trends and patterns of incidence of low income in California are complex and diverse, yet some of the most dramatic can be seen in Census and tax data. From 1975 to 2014 real (inflation-adjusted) incomes have fallen for all but the highest earners (those in the top 20th percentile). This pattern is volatile—in some years lower incomes grew, in some they fell sharply—but on average the bottom 20th percentile has seen a decrease in income of 1% per year. [14][15] Correspondingly, the percent of Californians with income below their poverty threshold has risen and fallen, but has on average increased by a tenth of a percentage point per year. [16]

- [Plan: plot Lorenz curve with historical comparisons to illustrate this]

- Improved graphic I created from Census data[17]:

- About a quarter of the people in the 1–2× bracket would be below their poverty line if benefits from welfare programs (especially CalFresh, earned income tax credits, and CalWORKs) weren't included in their incomes.[12]

- Original graphics I created from Census data[17]:

Distribution of incomes in California in 2016. The total height of the bars show the percentage of California's population that earns an individual income in each bracket; the height of the red portion indicates the percentage of California's population that is in that personal income bracket and has a household income below their CE (Consumer Expenditure, or cost-of-living adjusted) poverty threshold.

Distribution of incomes in California in 2016. The total height of the bars show the percentage of California's population that earns an individual income in each bracket; the height of the red portion indicates the percentage of California's population that is in that personal income bracket and has a household income below their CE (Consumer Expenditure, or cost-of-living adjusted) poverty threshold. Difference Between California and US Income Distributions in 2016. The gold bars show the increase (or decrease) in the percent of Californians in each bracket relative to the U.S. distribution as a baseline (difference in percentage points, not percent change). Note that these bars must sum to 0; they show that California has relatively more residents with no income or income over $100,000 than the U.S. as a whole, with correspondingly fewer residents in the middle brackets, especially the $25,000–$60,000 range. The red bars indicate a similar difference in distributions, showing the increase relative to the U.S. distribution of Californians in each bracket with household income below their CE-based poverty threshold (as percentages of California's total population). These bars sum to 7.8%, not 0, since 20.7% of California's population has inadequate income as compared to 12.9% in the U.S. as a whole.

Difference Between California and US Income Distributions in 2016. The gold bars show the increase (or decrease) in the percent of Californians in each bracket relative to the U.S. distribution as a baseline (difference in percentage points, not percent change). Note that these bars must sum to 0; they show that California has relatively more residents with no income or income over $100,000 than the U.S. as a whole, with correspondingly fewer residents in the middle brackets, especially the $25,000–$60,000 range. The red bars indicate a similar difference in distributions, showing the increase relative to the U.S. distribution of Californians in each bracket with household income below their CE-based poverty threshold (as percentages of California's total population). These bars sum to 7.8%, not 0, since 20.7% of California's population has inadequate income as compared to 12.9% in the U.S. as a whole.

- Oakland is the site of an interesting example of the varied and complex interactions between employment and other demographic characteristics. The City of Oakland implemented the nation's first policy of targeting bilingual applicants for public-facing city jobs in 2001 in response to growing Chinese- ad Spanish-speaking populations. This increased the public employment of Hispanic and Chinese bilinguals, not just in the targeted public-facing positions, but in other sectors as well. Correspondingly, the policy resulted in a decrease in Black monolingual employment. Hence a policy intended to remove lingual barriers to city services also had notable impacts on the racial segmentation of public employment, and so on racial differences in income. [18]

- The significant income inequality in California has many effects on Californians' lives, but one of the easiest to measure is life expectancy. This can be taken as a proxy for health or even general welfare. A study conducted by Clarke et al. related life expectancy to socio-economic status (SES, an index including income and other related factors), finding that Californians in the top 20% by SES live on average 6 years longer than those in the bottom 20% (81 years, compared to 75). This disparity becomes even more pronounced when studied in intersection with race: White males in the top 20% live 14 years longer than African American males in the bottom 20% (for females the difference is 10 years. This illustrates both the extreme extent of socio-economic inequality in California, and its severe consequences.[19]

Bibliography

[edit]Governance and Sovereignty of Indigenous peoples of California (Area: California):

[edit]- [20]Sanders, Catherine Adelle (2003). "Sovereignty empowered by governance among California tribal nations" (Document). United States -- California: University of Southern California. ProQuest 305293484.

{{cite document}}: Unknown parameter|accessdate=ignored (help); Unknown parameter|url=ignored (help) This dissertation provides an in-depth literature review, as well as several case studies. Discusses both historical context and modern dynamics of sovreignty and governance of native tribes in California. - [1]Tina Norris; Paula L. Vines; Elizabeth M. Hoeffel. The American Indian an Alaska Native Population: 2010 (PDF). U. S. Census Bureau. Retrieved 2018-03-04. U.S. Census facts and analysis of the AIAN race classification, including national context for California data as well as historical context from the 2000 census.

- [5]California Welf. & Inst. Code § 10553, retrieved 2018-03-03 — California Statutes pertaining to Tribal TANF and Foster Care.

- [2]California Dept. of Social Services. "Tribal TANF". Retrieved 2018-03-03. — Perspective of the State on Tribal TANF and how it relates to CalWORKs.

- [4]CalWORKs Facts and Figures 2017 (PDF). California Dept. of Social Services. January 2017. Retrieved 2018-03-01. — Provides details on the funding sources of CalWORKS (state and federal).

Welfare in California (Sector: Public Policy):

[edit]- [10]Bertram, Eva (2015). The Workfare State: Public Assistance Politics from the New Deal to the New Democrats. University of Pennsylvania Press. ISBN 978-0-8122-0625-8. Retrieved 2018-02-21. This book offers both a literature review of what the author sees as the mainstream views on welfare as well as a critique from the perspective that 'workfare' borders on the extractive or exploitative. This has relevance to California's CalWORKs, and can set it in the national context (is it more or less exploitative than other TANF implementations?) as well as historical (is TANF growing more or less exploitative?).

- [9]Davis, Lois M.; Karoly, Lynn A.; Bozick, Robert; Lavery, Diana Catherine; Barnes-Proby, Dionne; Weidmer, Beverly A.; Iyiewuare, Praise O.; Schweig, Jonathan; Fain, Gabriele; Kitmitto, Sami; Turk-Bicakci, Lori; Graczewski, Cheryl; Anthony, Jennifer; Bos, Johannes M.; Fronberg, Kaitlin; Castro, Marina; Arellanes, Melissa; Horinouchi, Andrew; Blankenship, Charles (2016). "Evaluation of the SB 1041 Reforms to California's CalWORKs Welfare-to-Work Program" (Product Page). Retrieved 2018-02-21. This provides an in-depth analysis of changes in CalWORKs that took place in 2012. It brings in a politics-centered frame, revealing how the legislature is treating CalWORKs.

- [21]Albert, Vicky N. (2000). "The role of the economy and welfare policies in shaping welfare caseloads: The California experience". Social Work Research; Oxford. 24 (4): 197–210. doi:10.1093/swr/24.4.197. ISSN 1070-5309. Retrieved 2018-02-21. This offers some insight about how programs are actually used, and adds emphasis to the perspective of the caseworker.

- [12]Sarah Bohn; Caroline Danielson; Tess Thorman (2017). "Poverty in California". Public Policy Institute of California. Retrieved 2018-04-27. This documents the efficacy of various welfare programs at reducing the poverty rate (California Poverty Measure).

- [13]Fox, Liana (2017-09-21). The Supplemental Poverty Measure: 2016. US Census Bureau. Retrieved 2017-10-02. This documents the efficacy of various welfare programs at reducing the poverty rate (Supplemental Poverty Measure).

- [22]Reese, Ellen; Ramirez, Elvia (2002-05-01). "The New Ethnic Politics of Welfare: Struggles Over Legal Immigrants' Rights to Welfare in California". Journal of Poverty. 6 (3): 29–62. doi:10.1300/J134v06n03_02. ISSN 1087-5549. S2CID 154537300. Retrieved 2018-02-21. This offers a perspective on access to welfare, as well as on the politics behind welfare programs.

- [3]Lower-Basch, Elizabeth (January 2018). Work Participation Rate. Washington, D.C.: CLASP. This offers details on the relationship between TANF and state implementations, with focus on the workfare requirement.

- [6] Karoly, Lynn A.; et al. (2015). Evaluation of the SB 1041 Reforms to California's CalWORKs Program: Background and Study Design. Santa Monica, CA: RAND Corporation.

{{cite conference}}: Explicit use of et al. in:|last=(help) This source provides a detailed review of the background of CalWORKs, focussing on the political and policy context. - [8] CalWORKs Program Fact Sheet January 2017 (PDF). California Department of Social Services. January 2017. Retrieved 2018-02-28. This source provides a view into the State's overt motivations at work in designing CalWORKs.

- [23]Rowe, Stacy (2003). "Practicing policy and making myth: Applied anthropology and homeless service delivery in Glendale, California" (Document). United States -- California: University of Southern California.

{{cite document}}: Unknown parameter|accessdate=ignored (help); Unknown parameter|url=ignored (help) This ethnography provides much-needed information from welfare recipients' perspectives. Although it is focussed on homelessness, governance and welfare policy play key rolls. The source is 15 years old, hardly fresh but still in the post-welfare-reform era. - [7]Hotz, V. Joseph; Mullin, Charles H.; Scholz, John Karl (2002). "Welfare, Employment, and Income: Evidence on the Effects of Benefit Reductions from California". The American Economic Review. 92 (2): 380–384. doi:10.1257/000282802320191651. ISSN 0002-8282. JSTOR 3083436. Retrieved 2018-02-21. This article details a study conducted by the State of California in the 90's on the effects of a reduction to AFDC benefits.

- [11]De Marco, Allison; Austin, Michael; Chow, Julian (2008-12-02). "Making the Transition from Welfare to Work: Employment Experiences of CalWORKs Participants in the San Francisco Bay Area". Journal of Human Behavior in the Social Environment. 18 (4): 414–440. doi:10.1080/10911350802486809. ISSN 1091-1359. S2CID 143456413. Retrieved 2018-04-28. This study relates CalWORKs participants experiences and opinions of the program.

Demographics of California (Area: California):

[edit]- [17]US Census Bureau (2017). Current Population Survey, Annual Social and Economic Supplement, 2017. Retrieved 2017-09-26. It would be helpful to report Supplemental Poverty Measure rates (and possibly old-style poverty rates), as well as data on income.

- [14]Sisney, Jason; Uhler, Brian (2016-09-06). "Data on Real Income Growth Trends by Percentile, 1990-2014". Legislative Analyst's Office (Califorrnia Legislature). Retrieved 2017-10-02. This source provides data on average per capita income and income distributions. It draws comparisons to other states and shows differences between regions within California. It also provides historical context from the past two decades, highlighting trends. It offers a way to bring in an income-focused frame.

- [15]Hill, Elizabeth G. (2000). California's Changing Income Distribution (PDF). Legislative Analyst's Office (Califorrnia Legislature). Retrieved 2017-09-30. This documents income inequality in detail, from a politically-motivated frame.

- [18]Sewell, Abigail A. (2017). "THE (UN)INTENDED CONSEQUENCES OF BILINGUAL EMPLOYMENT POLICIES: Ethnoraciality and Labor Market Segmentation in Alameda County, CA". Du Bois Review; Cambridge. 14 (1): 117–143. doi:10.1017/S1742058X16000345. ISSN 1742-058X. Retrieved 2018-02-22. This offers a employment-centred perspective on income and poverty. It is narrowly focused by geography and demographic segment, but this makes it a useful illustrative example.

- [19]Clarke, Christina A.; Miller, Tim; Chang, Ellen T.; Yin, Daixin; Cockburn, Myles; Gomez, Scarlett L. (2010). "Racial and social class gradients in life expectancy in contemporary California". Social Science & Medicine; Oxford. 70 (9): 1373–80. doi:10.1016/j.socscimed.2010.01.003. ISSN 0277-9536. PMC 2849870. PMID 20171001. Retrieved 2018-02-22. This source uses a socioeconomic index computed from several factors to offer a more broadly-defined frame; the correlation to life expectancy may be less relevant to this article than the description and mapping of class in California.

- [16]Flood, Sarah; King, Miriam; Ruggles, Steven; Warren, J. Robert (2015), Integrated Public Use Microdata Series, Current Population Survey: Version 4.0, Minneapolis, MN: University of Minnesota, retrieved 2017-10-02 This database relates CPS data to more indicators, including various microdata.

Evaluating two articles

[edit]Welfare in California (Sector: Public Policy):

[edit]- The lead focuses on the administrative structure of welfare programs and how authority over them is distributed between Federal, State and county governments. While this is significant, it is not necessarily the most salient summary of the topic. The remainder of the article describes the benefits offered by various programs—highlights from this information should be in the lead.

- Possible frames/viewpoints: Welfare in California is…

- …one particular implementation of Federal requirements, interesting merely because each State's implementation is different. This seems to be the frame in which most of the current article is written, and is valuable for its encyclopedic delivery of details of welfare programs.

- …a product of the political system, interesting because of what it shows us about the balance of power and law-making priorities of the State and other governments. This viewpoint would be helpful to some readers and, provided ample sources are available, is notable enough to merit expanding in the article. It is currently barely presented at all. Doing research on this angle would be quite helpful for my PE, which will put me into the middle of this political system.

- …something that affects millions of people's lives. It seems that more discussion of the effects of welfare policy, as opposed to merely what programs exist, is merited. This could be from the viewpoint of either recipients or providers (e.g. at the county or program level), or both. Perhaps the viewpoints of three main stakeholders deserve equal space: policymakers, service providers, and users.

- Changing the structure of the article could help include some of these frames, such as by breaking it into sections by type of welfare (e.g. food, housing, income, etc.). This would create space for overviews of each welfare type that would allow for comparison to other states, discussion of legislative priorities, and information about need/demand.

- The article is included in WikiProject California, but is unrated in quality and importance. Am I qualified to rate it?

- The article is fairly well-sourced, although it relies heavily on publications of the welfare agencies themselves (this seems fairly reliable in this context). Some facts and figures could be updated.

Demographics of California (Area: California):

[edit]- A key issue with this article is that many figures are several years out of date.

- The organization could be more clear. The "Birth Data" section should at most be a sub-part of a section on race and/or ethnicity. Also, the "National Origin" section includes much discussion of race and ethnicity. While all three of these ideas are closely related, presenting information about race as information about national origin could reinforce stereotypes of members of some races being foreigners. In many places "ethnicity" refers to a binary Hispanic–Non-Hispanic classification—this is notable information given California's Hispanic history, but should be described as such, both to give the space due to this ethnicity and avoid implying no other ethnicities are present in California.

- Discussion of income and poverty are entirely absent from the article. This is an important frame to expand for the article and for myself, given my PE.

- Much of this article cites solid Census data, but several sources are newspapers or other popular media that may not meet Wikipedia's standards. This could likely be improved by following these sources own citations (where available).

Possible articles for Wiki Ed project:

[edit]Sector: Public Policy

[edit]- Expand Welfare in California

- Generally clarify and add details—this could be accomplished by restructuring as described above

- Add historical context

- Add national context: compare to other states, and discuss what programs are federally administered or mandated

- Add information about the cost to the State of providing programs.

- Add information about usage of programs, both from an efficacy perspective and highlighting what sectors of the population might be included or excluded.

- Plan: first priorities are to add information that frames welfare programs (1) in terms of their effects and (2) in terms of their political genesis. Once this information is included, a broader restructuring (see above) may be useful. Consider also adding applicable information to more specific pages as you go (such as CalWORKS or CalEITC).

- Expand CalWORKs

- Add CalEITC

Area: California

[edit]- Expand stub Eastern California (High importance in WikiProject California)

- Demographics

- Economy

- Governance—what are the roles of county, state, and federal authorities? How do local (sub–county-level) fit in?

- Demographics of California

- Add discussion of income distributions and poverty—connect to talk on California's regional demography

- Update census and other data, as discussed in 2012

- Plan: First priority is to add a section on income and poverty.

- Useful graphics to create:

- Income distribution with bars divided into in and out of SPM poverty

- Income distribution showing changes over time

- Income distribution comparing to nation-wide totals

- Lorenz curve (Gini coefficient)(compare to history, nation)

- Does this exist in other places? Some mentions, but no comprehensive overview (at least not where people like me could find it):

- Some list articles (e.g. California locations by per capita income)

- California#Economy (a few lines)

- Economy of California#Personal income (a few lines)

- Information about narrower locations can be found on some pages for different regions.

- Useful graphics to create:

- Information about governance in California, especially politics within the legislature and in how it relates to other branches of government, federal government, and local governments.

- Add explanation for shift from GOP to DEM in past 100y that is illustrated in Political party strength in California

- Update and expand California state finances, emphasizing ways the allocation of money and levying of taxes might reflect the government's priorities

- Add information about gerrymandering to Districts in California and Redistricting in California

- Contribute to Politics of California, especially by adding some organization to the "Political issues" section

- Expand Big Five (California politics)

- Add emphasis of politics, as opposed to the current focus on procedure, to California State Legislature and California State Senate.

More ideas:

[edit]- Start class top priority articles in WikiProject California

- Outline of California

- details on a particular aspect of CA human services policy, e.g. health, housing (incl. foster care, Housing First), food, income (incl.CalWORKs, CalEITC), education (from child care to after-school proggrams to CCCs), etc.

- Theories of poverty

Combined List of References

[edit]- ^ a b Tina Norris; Paula L. Vines; Elizabeth M. Hoeffel. The American Indian an Alaska Native Population: 2010 (PDF). U. S. Census Bureau. Retrieved 2018-03-04.

- ^ a b California Dept. of Social Services. "Tribal TANF". Retrieved 2018-03-03.

- ^ a b c Lower-Basch, Elizabeth (January 2018). Work Participation Rate. Washington, D.C.: CLASP.

- ^ a b CalWORKs Facts and Figures 2017 (PDF). California Dept. of Social Services. January 2017. Retrieved 2018-03-01.

- ^ a b California Welf. & Inst. Code § 10553, retrieved 2018-03-03

- ^ a b c d Karoly, Lynn A.; et al. (2015). Evaluation of the SB 1041 Reforms to California's CalWORKs Program: Background and Study Design. Santa Monica, CA: RAND Corporation.

{{cite conference}}: Explicit use of et al. in:|last=(help) - ^ a b c Hotz, V. Joseph; Mullin, Charles H.; Scholz, John Karl (2002). "Welfare, Employment, and Income: Evidence on the Effects of Benefit Reductions from California". The American Economic Review. 92 (2): 380–384. doi:10.1257/000282802320191651. ISSN 0002-8282. JSTOR 3083436. Retrieved 2018-02-21.

- ^ a b CalWORKs Program Fact Sheet January 2017 (PDF). California Department of Social Services. January 2017. Retrieved 2018-02-28.

- ^ a b c Davis, Lois M.; Karoly, Lynn A.; Bozick, Robert; Lavery, Diana Catherine; Barnes-Proby, Dionne; Weidmer, Beverly A.; Iyiewuare, Praise O.; Schweig, Jonathan; Fain, Gabriele; Kitmitto, Sami; Turk-Bicakci, Lori; Graczewski, Cheryl; Anthony, Jennifer; Bos, Johannes M.; Fronberg, Kaitlin; Castro, Marina; Arellanes, Melissa; Horinouchi, Andrew; Blankenship, Charles (2016). "Evaluation of the SB 1041 Reforms to California's CalWORKs Welfare-to-Work Program" (Product Page). Retrieved 2018-02-21.

- ^ a b Bertram, Eva (2015). The Workfare State: Public Assistance Politics from the New Deal to the New Democrats. University of Pennsylvania Press. ISBN 978-0-8122-0625-8. Retrieved 2018-02-21.

- ^ a b c De Marco, Allison; Austin, Michael; Chow, Julian (2008-12-02). "Making the Transition from Welfare to Work: Employment Experiences of CalWORKs Participants in the San Francisco Bay Area". Journal of Human Behavior in the Social Environment. 18 (4): 414–440. doi:10.1080/10911350802486809. ISSN 1091-1359. S2CID 143456413. Retrieved 2018-04-28.

- ^ a b c d Sarah Bohn; Caroline Danielson; Tess Thorman (2017). "Poverty in California". Public Policy Institute of California. Retrieved 2018-04-27.

- ^ a b Fox, Liana (2017-09-21). The Supplemental Poverty Measure: 2016. US Census Bureau. Retrieved 2017-10-02.

- ^ a b Sisney, Jason; Uhler, Brian (2016-09-06). "Data on Real Income Growth Trends by Percentile, 1990-2014". Legislative Analyst's Office (Califorrnia Legislature). Retrieved 2017-10-02.

- ^ a b Hill, Elizabeth G. (2000). California's Changing Income Distribution (PDF). Legislative Analyst's Office (Califorrnia Legislature). Retrieved 2017-09-30.

- ^ a b Flood, Sarah; King, Miriam; Ruggles, Steven; Warren, J. Robert (2015), Integrated Public Use Microdata Series, Current Population Survey: Version 4.0, Minneapolis, MN: University of Minnesota, retrieved 2017-10-02

- ^ a b c US Census Bureau (2017). Current Population Survey, Annual Social and Economic Supplement, 2017. Retrieved 2017-09-26.

- ^ a b Sewell, Abigail A. (2017). "THE (UN)INTENDED CONSEQUENCES OF BILINGUAL EMPLOYMENT POLICIES: Ethnoraciality and Labor Market Segmentation in Alameda County, CA". Du Bois Review; Cambridge. 14 (1): 117–143. doi:10.1017/S1742058X16000345. ISSN 1742-058X. Retrieved 2018-02-22.

- ^ a b Clarke, Christina A.; Miller, Tim; Chang, Ellen T.; Yin, Daixin; Cockburn, Myles; Gomez, Scarlett L. (2010). "Racial and social class gradients in life expectancy in contemporary California". Social Science & Medicine; Oxford. 70 (9): 1373–80. doi:10.1016/j.socscimed.2010.01.003. ISSN 0277-9536. PMC 2849870. PMID 20171001. Retrieved 2018-02-22.

- ^ Sanders, Catherine Adelle (2003). "Sovereignty empowered by governance among California tribal nations" (Document). United States -- California: University of Southern California. ProQuest 305293484.

{{cite document}}: Unknown parameter|accessdate=ignored (help); Unknown parameter|url=ignored (help) - ^ Albert, Vicky N. (2000). "The role of the economy and welfare policies in shaping welfare caseloads: The California experience". Social Work Research; Oxford. 24 (4): 197–210. doi:10.1093/swr/24.4.197. ISSN 1070-5309. Retrieved 2018-02-21.

- ^ Reese, Ellen; Ramirez, Elvia (2002-05-01). "The New Ethnic Politics of Welfare: Struggles Over Legal Immigrants' Rights to Welfare in California". Journal of Poverty. 6 (3): 29–62. doi:10.1300/J134v06n03_02. ISSN 1087-5549. S2CID 154537300. Retrieved 2018-02-21.

- ^ Rowe, Stacy (2003). "Practicing policy and making myth: Applied anthropology and homeless service delivery in Glendale, California" (Document). United States -- California: University of Southern California.

{{cite document}}: Unknown parameter|accessdate=ignored (help); Unknown parameter|url=ignored (help)